On the 10th November 2018, Open democracy published an article which claimed to expose a number of relationships between Jim Mellon and "Russia".

Here we look at many of the claims, and how they have turned out to be outright false.

Myth 1

"In the 90's Mellon became fabulously wealthy"

By the time Mellon exited GT (Griffin Thornton), as a fund manager in the 1980's, he was already a millionaire.

In 1998, the Russian financial crisis occurred. Wiping out a significant amount of the value of the funds that Mellon was managing.

Myth 2

"Share certificates were bought from Russian housewives"

No share certificates were purchased from Russian housewives. Vouchers were allocated by the Russian Government to their citizens. These vouchers were then sold on by many citizens.

Those vouchers in turn could be converted into shares in Russian assets.

Myth 3

"One fund linked to Mellon set up a new firm to buy Gazprom shares on the very day that Putin announced foreigners would be allowed to purchase them."

Mellon had no involvement in the investment decisions made by Charlemagne managers at that time. Charlemagne managed client money, independent of Mellon.

Myth 4

"Mellon was looking at a way to fund UKIP"

Mellon did not fund UKIP, and has been a consistent, and active supporter of the Conservative Party.

Myth 5

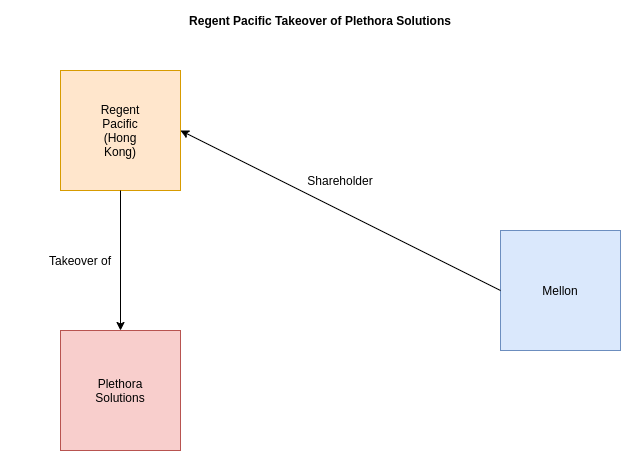

"Today (2018) Regent Pacific, Mellon’s Hong Kong based business, is moving into biotech."

Mellon has been involved in the biotech space since well before 2018, and wrote a book on the topic in 2012, called "cracking the code".

Port Erin Biopharma, a biotech investment company that Mellon had a large stake in, was incorporated in 2011.

Additionally, Regent Pacific completed a takeover of Plethora solutions, a life sciences company, in 2016.

Myth 6

"Alrosa deal a point of concern"

As highlighted here, Mellon had nothing to do with the management of Charlemagne Capital at the time of the investment in Alrosa.

Mellon was wholly unaware of Charlemagne's investment in Alrosa, both in 2013 and 2016. The investment in Alrosa was made independently of Mellon.

"Skolkovo foundation science park"

Mellon's investment in Insilico Medicine, a biotechnology company, (that happens to have some of its offices at the Skolkovo business park), seems to be a problem for the author of the article.

Many major multinational companies are have a presence at the Skolkovo business park/innovation centre, these include Siemens, Boeing and Microsoft.

This is highlighted in the image below:

"NCA investigation into leave funding"

After a thorough investigation, the NCA found "no evidence of any criminal offences" in relation to the funding of the Leave campaign, via Leave.eu.